Summary

Many homeowners worry about the cost of foundation repairs, but putting them off can lead to more damage and higher expenses. This blog explains practical ways to pay for these repairs using financing options available to homeowners in the U.S. It covers payment plans, loan types, what to expect during the process, and how to choose the best option based on your budget without the stress of upfront costs.

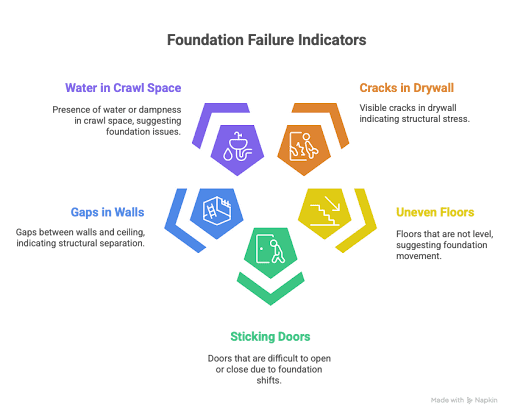

If you’ve recently discovered cracks in your walls, sagging floors, or doors that won’t shut like they used to, you’re probably thinking about what’s going on beneath your home. For many homeowners, signs of foundation problems come as a surprise and not a welcome one. You may be wondering what to do next or how serious it really is.

And once you do get an inspection or a quote, another big question often follows, “How do people pay for foundation repair? Is financing available?”

These are common concerns. Foundation issues can feel overwhelming, not just because of what’s happening to your house, but also because of what it might cost to fix. The idea of paying thousands of dollars all at once can put a lot of pressure on a family budget.

But the truth is, you’re not stuck. There are foundation repair financing options available, and they’re designed to help homeowners handle this type of situation without putting everything else on hold.

Whether you’re just researching or already facing a repair decision, this guide aims to give you a clearer picture of your options.

Why Foundation Repairs Matter

Your foundation is what holds your house up. When it’s damaged, everything above it can shift or break. That includes your floors, walls, windows, plumbing, and even your roof. Ignoring a foundation issue doesn’t make it go away, it just gets worse, and more expensive, over time.

But the high cost of repairs can stop many people from acting. That’s where foundation repair with financing becomes helpful. Instead of paying thousands of dollars all at once, you can spread the cost over time and protect your home now.

What Is Foundation Repair Financing?

Foundation repair financing is a way to pay for repairs through monthly payments instead of one big upfront payment. Just like buying a car or using a credit card, financing lets you fix what’s broken now, and pay it off later. Most professional foundation repair companies offer financing for foundation repair with trusted partners that make it easy to apply and get approved.

Common Options Include:

- In-house financing through the repair company

- Personal loans from banks or lenders

- Home equity loans or lines of credit (HELOCs)

- Credit cards for smaller repair amounts

Each option has pros and cons depending on your credit score, how much equity you have in your home, and how quickly you want to get started.

Can You Finance Foundation Repair Even with Bad Credit?

Yes, you often can. Some companies that offer foundation repair with financing work with lenders that specialize in helping homeowners with less-than-perfect credit. While your interest rate may be higher, it can still be more affordable than waiting and risking more damage.

If you’re wondering, can you finance foundation repair, even without great credit, the answer is often yes. Many lenders understand that this is a necessary home safety issue and offer options that don’t require a perfect score.

How to Pay for Foundation Repair: 5 Popular Financing Options

Here are the most common ways people in the U.S. handle how to pay for foundation repair, with a breakdown of how each works.

1. In-House Foundation Repair Financing

Many repair companies now offer foundation repair financing directly through their own systems or lending partners. This is one of the fastest and easiest ways to get started.

Benefits:

- Fast approval (often same day)

- No third-party paperwork

- Flexible foundation repair payment plan options

Best for: Homeowners who want a fast, easy process and are working with a trusted local repair company.

2. Personal Loans

These are unsecured loans you can apply for through banks, credit unions, or online lenders. You receive a lump sum and pay it back monthly.

Benefits:

- Fixed interest rate and term

- No home equity required

- Can be used for other repairs too

Best for: Homeowners with good credit looking for predictable payments.

3. Home Equity Loans / HELOCs

If you’ve lived in your home for a while and built up value, you can borrow against it.

Benefits:

- Lower interest rates (because it’s secured)

- Higher loan amounts

- Tax-deductible interest (in some cases)

Best for: Homeowners with strong equity and stable income.

Note: This option takes longer to process, so it’s not ideal if you need urgent repairs.

4. Government Assistance Programs

Some local or state programs offer low-interest loans or grants for critical home repairs. These aren’t available everywhere, but it’s worth checking.

Best for: Seniors, low-income families, or those living in disaster zones.

5. Credit Cards

If the repair costs are smaller (under $5,000), a credit card might be a quick fix.

Benefits:

- Instant access to funds

- Rewards or cash back

Best for: Short-term needs with quick payoff plans

But be cautious, credit cards often come with high interest if not paid off fast.

What’s Included in Foundation Repair Costs?

Knowing what you’re paying for can help make financing feel less scary. Foundation repair costs depend on:

- Type of foundation (slab, crawl space, or basement)

- Extent of damage

- Location of the home

- Materials and equipment needed

- Labor and permits

For homes with crawl spaces, repair costs can vary depending on moisture levels, insulation issues, or structural damage. You can learn more about crawl space repair costs here.

How Do Payment Plans Work?

A foundation repair payment plan usually works like this:

- You get a quote for the repair.

- You apply for financing (usually takes a few minutes).

- If approved, you pick a plan often from 6 to 60 months.

- You make monthly payments while the work gets done right away.

Some plans offer zero-interest if paid in full within a certain time. Others have fixed interest and predictable payments. Either way, this is a smart route if paying in full upfront isn’t an option.

Foundation Repair with Financing: Is It Worth It?

Absolutely. Your foundation keeps your home safe and stable. Delaying repairs could lead to:

- Dangerous living conditions

- More expensive structural damage

- Lower property value

- Trouble selling your home in the future

By choosing foundation repair with financing, you protect your home and make a smart investment in its long-term value. It’s not just a cost, it’s peace of mind.

What Makes a Good Financing Partner?

Before signing up for any foundation repair financing, ask:

- Is there a credit check?

- What is the interest rate?

- Are there early payment penalties?

- How fast can I get approved?

- Can I get prequalified with no obligation?

A reliable company will help you understand every step of the process and work with lenders that fit your needs. Look for transparency, flexibility, and strong customer reviews.

Many homeowners explore financing when looking into foundation repairs. It can make the cost easier to manage over time, especially when repairs are urgent or unexpected. There are several flexible options available, depending on the homeowner’s needs and financial situation.

Understanding Your Foundation Repair Financing Options

Many homeowners explore financing when looking into foundation repairs. It can make the cost easier to manage over time, especially when repairs are urgent or unexpected. There are several flexible options available, depending on the homeowner’s needs and financial situation.

Virginia Foundation Solutions provides financing options for customers in the Hampton Roads, Richmond, and Northeastern North Carolina areas. The goal is to offer a straightforward path to starting foundation or crawlspace repairs without added financial pressure.

Financing is available through trusted lending partners. These options are designed to fit a range of budgets and include:

- Simple payment plans

- No hidden fees or closing costs

- No prepayment penalties

- Competitive interest rates

- 0% financing options

- Unsecured loans (no collateral required)

After the inspection, a Certified Foundation Specialist will share a quote and explain which financing plans may be available. Approvals are often quick, and plans can be tailored based on the project’s scope and budget.

For more information, customers can speak directly with their Certified Foundation Specialist or send an email to contact@vfsworks.com.

Thinking About Financing? You’re Not Alone

Dealing with home repairs is never easy—especially when the problem is below the surface and the cost feels out of reach. But waiting often makes things worse, both structurally and financially. That’s why more homeowners are choosing to explore foundation repair financing early, instead of postponing the work.

At Virginia Foundation Solutions, we’ve helped many families across Hampton Roads, Richmond, and Northeastern North Carolina areas understand their options. If you’ve been asking yourself, “Can I finance foundation repair?”, the answer is usually yes. The key is finding a plan that fits your budget and timeline.

Financing doesn’t have to be complicated. And it’s okay if you’re not sure what the right next step looks like. We’re here to walk through it with you.

Want to talk it over or get a sense of your options? Reach out to us.

Frequently Asked Questions

1. Can I get foundation repair financing with bad credit?

Yes, many foundation repair companies work with lending partners who offer financing options for homeowners with less-than-perfect credit. While your interest rate may be higher, you can usually still qualify for a payment plan and get repairs started quickly.

2. How fast can I get approved for foundation repair financing?

Approval is often quick, sometimes within minutes especially when applying through your repair company’s in-house financing or lending partner. Personal loans and home equity loans may take longer, depending on the lender.

3. Are there zero-interest or same-as-cash options available?

Yes, some companies offer promotional financing such as 0% interest or “same-as-cash” deals if you pay off the balance within a set period (often 6 to 12 months). Be sure to ask your contractor about these options before committing.

4. Does homeowner’s insurance ever cover foundation repairs?

In most cases, homeowner’s insurance does not cover foundation repairs unless the damage is caused by a covered event, like a natural disaster. It’s always a good idea to check with your insurance provider to confirm your specific coverage.

5. Will financing affect my credit score?

Applying for financing may involve a credit check, which can have a small, temporary impact on your credit score. Some lenders offer prequalification with no impact to your score, so ask about this option before applying.

6. Can I pay off my foundation repair loan early without penalty?

Many financing plans do not have prepayment penalties, allowing you to pay off your balance early and save on interest. Always confirm this with your lender before signing any agreement.

7. How do I choose the best financing option for my situation?

Consider your credit score, how quickly you need repairs, the total cost, and your monthly budget. Compare interest rates, repayment terms, and any fees. A trustworthy contractor or financial advisor can help you review your options and pick what works best for you.